Want to be rewarded for helping to build permanent charitable funds that benefit Howard County? Participate in Endow Maryland, and give back to your community in a meaningful and lasting way.

How It Works

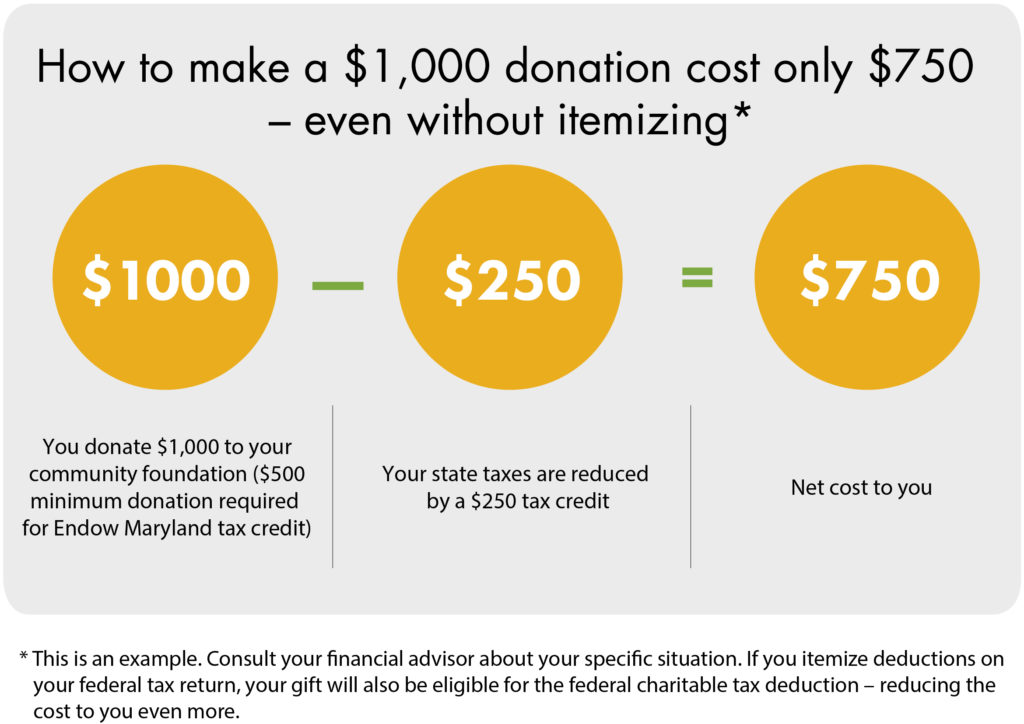

Endow Maryland is a state tax credit that rewards donors who help build permanent, endowed charitable funds for local communities across the state – including right here in Howard County. Only donations of $500 or more made by the taxpayer to a “qualified permanent endowment fund” at an “eligible community foundation” are eligible for tax credits. These gifts will generate many times the initial value of the gift in benefit to the community.

Benefits for the Community and You

Here at the Community Foundation of Howard County, Endow Maryland will help build our Fund for the Common Good and Next 50 Campaign – a permanent unrestricted endowment fund that allows us to address Howard County’s most pressing needs through our community grants program. This gift may qualify for a 25% State of Maryland corporate income tax, personal income tax, insurance premiums tax or public service company franchise tax credit.

There are limited credits available, so we encourage anyone who is interested to contact us promptly. These credits are available on a first-come, first-served basis.

Tax credits are only available for new contributions so a grant from your donor advised fund or IRA charitable rollover would not be eligible. Contributions may be made in the form of a personal check or stock gift.

How Can I Apply?

Please contact Dan Flynn, Director of Development, to verify that credits are still available for this calendar year, or to learn about what funds qualify. More information is available on the State of Maryland website.

Download, print, and complete the Endow Maryland Certification of Contribution Form. (required for each contribution.)

Download, print, and complete the Endow Maryland Waiver of Information Form. (required annually.)

Return the form to the Community Foundation by choosing one of the following:

- scan and email

- drop off or mail to: 10440 Little Patuxent Parkway, Suite 230, Columbia, MD 21044

- fax to 410.997.6021