Are you looking for a tax-efficient way to make a difference in your community? If you have an Individual Retirement Account (IRA), you may want to consider a Qualified Charitable Distribution (QCD). This powerful tax strategy allows you to support causes close to your heart while reducing your taxable income. In this blog post, we will explore the benefits of QCDs (sometimes called an IRA Rollover) and how the Community Foundation of Howard County can help you unleash the power of philanthropy.

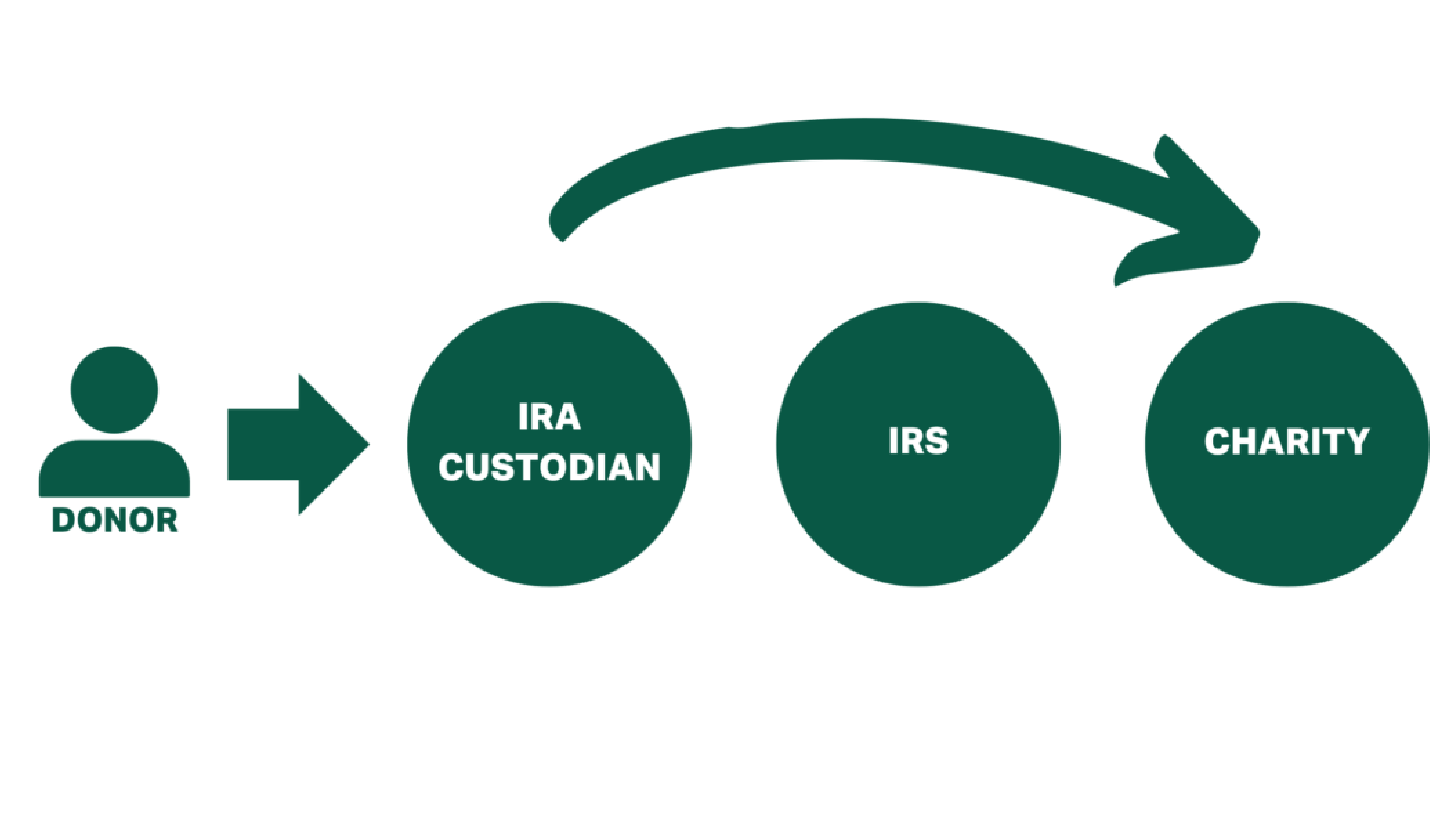

A Qualified Charitable Distribution is a direct transfer of funds from your IRA to a qualified charitable organization up to $100,000 annually. The great advantage of a QCD is that it can count towards your Required Minimum Distribution (RMD) while excluding the distribution from your taxable income. This means that if you’re 70.5 years or older, you can satisfy your RMD and support philanthropic causes simultaneously. This tax-efficient strategy makes it a win-win for both you and the causes close to your heart.

DOWNLOAD COMPLIMENTARY QCD BROCHURE

The Community Foundation of Howard County (CFHoCo) is a nonprofit organization dedicated to connecting donors with local causes. CFHoCo serves as a philanthropic catalyst, providing strategic leadership and resources to address community needs. By partnering with CFHoCo, you can maximize the impact of your QCD and ensure that your charitable dollars make a lasting difference in Howard County.

Why should you consider a QCD?

1. Tax benefits: By directing your RMD to a charity through a QCD, you can reduce your taxable income. This can be particularly advantageous if you do not need the full amount of your RMD for personal expenses.

2. Simplified giving: A QCD makes philanthropy seamless. Instead of receiving the distribution and then donating to charities, the QCD allows for a direct transfer to the charitable organization of your choice. This simplifies the giving process and ensures that your donation reaches its intended recipient efficiently.

3. Community impact: When you choose to support local charities through the Community Foundation of Howard County, you are making a direct impact on the well-being of your community. Whether you’re passionate about education, healthcare, the environment, or any other cause, your QCD can help drive positive change where it matters most.

To initiate a QCD, you should first consult with your financial advisor or IRA custodian to ensure that you meet the necessary requirements. They can guide you through the process and provide all the paperwork needed to execute the distribution. Once you have completed the necessary steps, you can work with the Community Foundation of Howard County to determine the charitable organizations you wish to support.

A Qualified Charitable Distribution from your IRA is a powerful tax strategy that allows you to combine financial planning with philanthropy. By partnering with the Community Foundation of Howard County, you can make a lasting impact on your community while reducing your taxable income. Explore the options available to you and unlock the potential of your retirement funds to create positive change in Howard County. Together, we can make a difference!

Contact Dan Flynn: dflynn@cfhoco.org 410-730-7840 x8